Medicare Made Simple in Milford

As your dedicated Medicare advisor in Milford, Medicare Benefits Group will help you compare Medicare Advantage, Medigap, and Part D with your doctors and prescriptions in mind. Serving Milford neighbors near the Milford Senior Center and throughout southeastern Michigan, we make plan choices clearer, costs more predictable, and enrollment easier—without pressure.

Plain-English Answers, Right Here at Home

Why Milford Residents Choose Us

We look up your Milford providers, confirm pharmacy preferences, and review your medications before recommending anything. You’ll see side-by-side comparisons, transparent costs, and help during Annual Enrollment (Oct 15–Dec 7) or whenever life changes. Close to Commerce Township—and convenient to Novi and Farmington Hills—our approach is simple: listen first, compare carefully, and enroll when you’re ready with a local Medicare agent in Milford that you can reach by phone or video.

How Original Medicare Works

Medicare is the Federal health insurance program for:

- People who are age 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

There are two different parts of Original Medicare that help cover specific services which are referred to as Part A and Part B. For a summary of premiums, deductibles, coinsurance, and other costs associated to Part A and Part B, click here →

Medicare Part A (Hospital Insurance)

In general, think of this like ‘room and board’ when you’re in the hospital. This is an entitlement benefit, meaning most people are entitled to their Part A at age 65 because they have paid into Social Security and Medicare as part of their income taxes every year and therefore are entitled to Part A premium-free. The deductibles, coinsurance, and out-of-pocket costs within Part A can quickly add up.

Medicare Part B (Medical Insurance)

Most people associate Medicare coverage with Part B because this is the major medical, or ‘doctoring,’ part. This includes services such as doctor visits, labs, x-rays, CT’s, surgeon fees, physical therapy, and everything in between. In 2025, most people will pay a monthly premium of $185.00 for Part B. Higher income earners will pay more due to an Income-Related Monthly Adjustment Amount, or IRMAA. The Part B premium deducts automatically out of a beneficiary’s Social Security income, or if the SSI is deferred, the Social Security Administration will mail a bill (usually quarterly). This premium gives the Medicare beneficiary 80/20 major medical coverage: Medicare pays 80% of major medical costs, leaving the Medicare beneficiary responsible for the other 20%, with no maximum out of pocket. Also, Part B's deductible in 2025 is $257 for the calendar year.

Explore Our Services

Medicare Advantage Plans (Part C) in Milford

HMO vs PPO—Find the Right Fit for You

Medicare Advantage plans available in Milford can bundle hospital, medical, and often drug coverage—sometimes with $0 premiums. We verify if your preferred doctors accept the plan, compare HMO vs PPO trade-offs, check star ratings, and review total annual cost (copays, MOOP, premiums). If you’re looking to enroll in Medicare Advantage in Milford, we’ll guide you through each step and the right timing.

Medigap (Medicare Supplement) for Milford

Plan G vs Plan N—Know Your Options

If freedom to see any Medicare-accepting provider is important, Medigap may be the right path. We explain Plan G vs Plan N, outline timing (including the six-month Medigap window tied to Part B), and compare carrier rates for stability over time. Many Michigan residents choose Medigap for predictable costs and pair it with a standalone Part D plan for full coverage across the board.

Medicare Prescription Drug Coverage (Part D)

Check Your Meds and Preferred Local Pharmacies

The right Part D plan can lower pharmacy costs in Milford. We run your medication list against each plan’s formulary, review tiers, and compare preferred retail vs mail-order pricing so you avoid surprises. If you’re working to compare Part D plans in Michigan, set up a review with our team—bring your medication list (with dosages), your Medicare card, and preferred pharmacies, and we’ll compare options side by side..

Other Insurance Options

Add Dental, Vision, or Hearing if You Need It

Looking beyond Medicare? We can explain options that complement your coverage—dental, vision, hearing—and how they work alongside Advantage or Medigap. We’ll help you decide if adding these benefits now (or later) makes sense for your needs in Milford and across southeastern Michigan.

What Our Clients Are Saying

We believe good service speaks for itself—and so do the people we’ve helped. Below are just a few kind words from individuals who turned to us for clear, one-on-one Medicare support. Check out more review here!

Recent 5 Star Reviews from Google

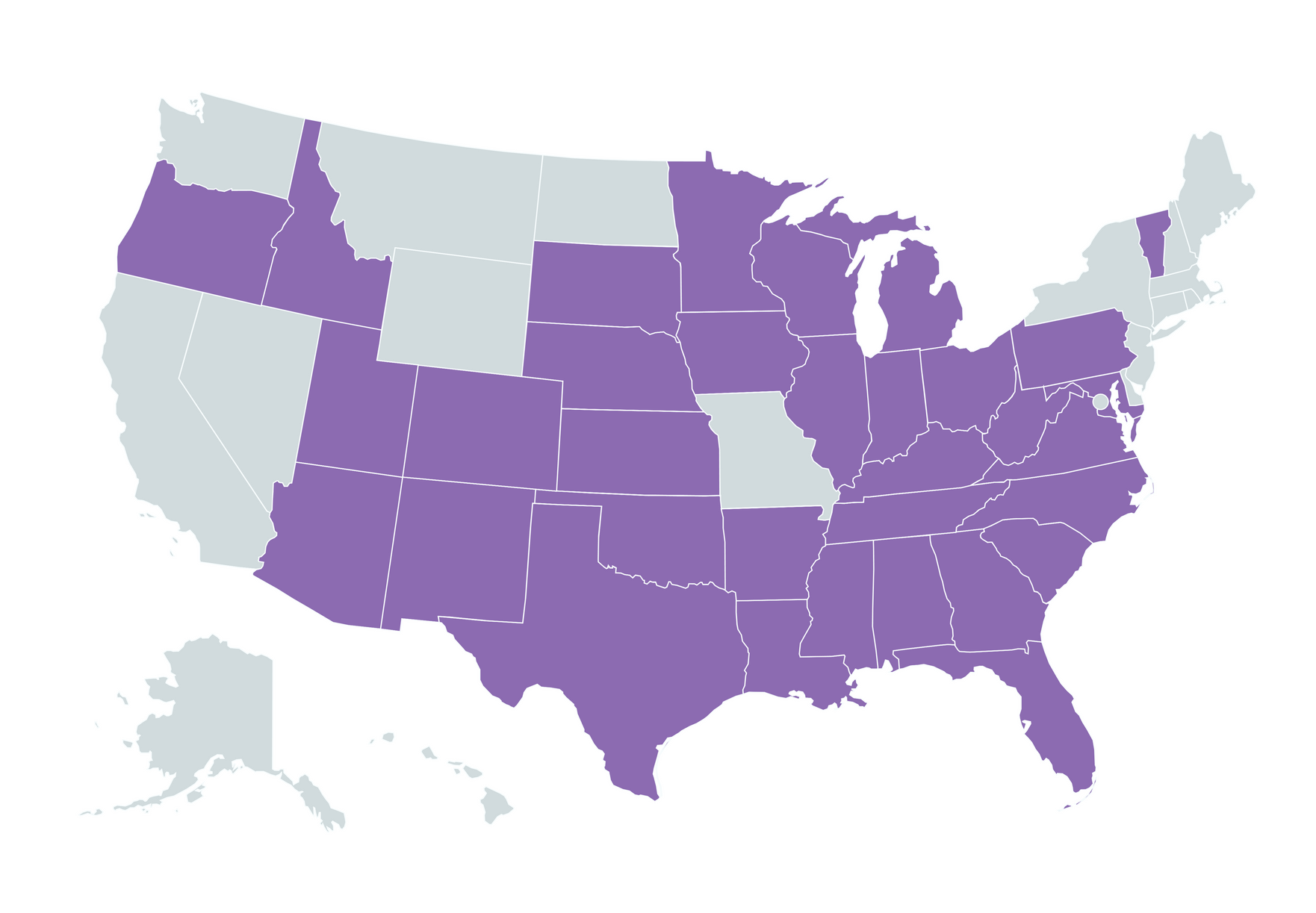

States We Insure

Medicare Benefits Group is proud to call Commerce Township home while helping people across Michigan and 33 other states. If you or family live nearby in southeastern Michigan—or are moving out of state—we can still walk you through your choices and enrollment.

frequently asked questions

Quick Answers for Milford Medicare Questions

Do you host meetings near the Senior Center?

Yes—phone, virtual, or at a in-person by appointment.

Can I keep my doctors if I switch?

We verify networks before any enrollment.

Are there $0 premium plans here?

Many counties offer $0 premium options; total cost varies by copays and benefits.

Can I change mid-year if I move?

Moving can qualify for a Special Enrollment Period (SEP); we’ll check your eligibility.

Do you coordinate Part D?

Yes—every recommendation includes a prescription review.

Licensed with Top Carriers in 34 States

We shop the top insurance companies so you don’t have to.

Let’s Talk Coverage in Milford

Have Medicare Questions? We’re Here to Help.

Call (734) 657-4797 or book a time that works for you. Whether you’re in Milford or elsewhere in southeastern Michigan, we’ll confirm your doctors and prescriptions, compare plans, and handle enrollment when you’re ready.